Add a new bank account for automatic payments (direct debit)

Are you adding a bank account to lift a Complyfile billing suspension? Follow these steps instead.

To make automatic payments for a Complyfile subscription using a new bank account, add the bank account to your Complyfile billing account and make it your primary payment method. After that, we'll debit that account for your automatic payments.

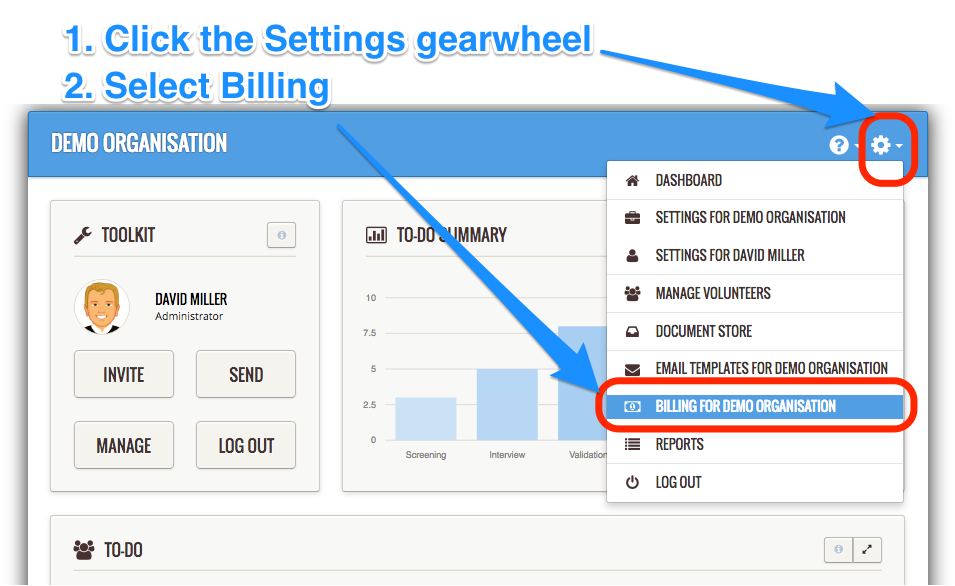

- In your Admin Dashboard, go to the Settings gearwheel in the top right of your screen.

- Select the dropdown link, 'Billing for [your organisation]'.

- Select your preferred billing plan and cycle (Monthly, Annual)

- Complete a new Mandate following the instructions below.

Paying by bank account is available in the US, UK, and some European countries. See also Payment options in my country

Creditor's Details

This section is pre-populated with Complyfile's details. We're known as the creditor as we're offering the service to you, and in exchange you set up your Direct Debit mandate. This section is for information purposes only.

Type of Payment

A payment from a bank account (also known as a Direct Debit) can either be a one-off payment (where only one payment is made), or a recurring payment (where the payment recurs at a set interval of time between payments).

Complyfile offers recurring payments plans (only), so the recurring payment option is automatically checked for your Direct Debit application.

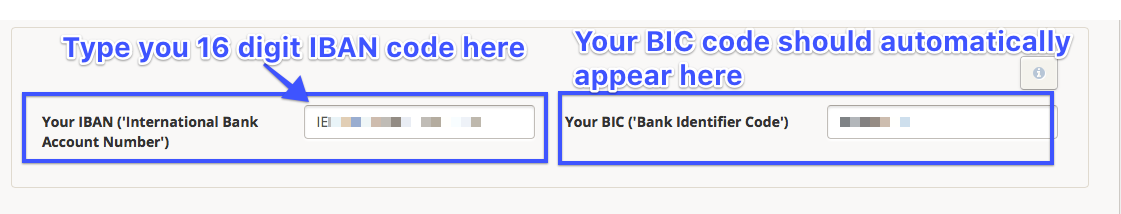

Where can I find my IBAN and BIC numbers for my bank account?

Your BIC and IBAN are printed on your bank statement. You can also request them directly from your bank.

In Ireland, The Irish Payment Services Organisation (IPSO) website also provides a BIC & IBAN conversion tool which will convert any domestic NSC and Account Number to its equivalent BIC & IBAN. To automatically convert any NSC and Account Number to its equivalent BIC and IBAN, use this free online tool here.

What's a BIC code?

The BIC or Bank Identifier Code (also known as the SWIFT address) is a unique address which in payment messages identifies precisely the bank involved in financial transactions.

When used in conjunction with the IBAN it identifies the bank at which the account of the beneficiary is held.

What's an IBAN?

IBAN stands for International Bank Account Number, and the concept was developed by the European Committee for Banking Standards (ECBS) and the International Standards Organisation (ISO) and is an internationally agreed standard (ISO 13616: 2003).

It was created as a viable and practical international bank account identifier, used internationally to uniquely identify the account of a customer at a financial institution, to assist error-free cross-border payments and to improve the potential for straight-through payment processing.

EU banks are legally required to provide their customers with an IBAN for each bank account. An example of an Irish IBAN is: IE64IRCE92050112345678.

Organisation Details

Fill in this section making sure that:

- the name of the organisation matches the name on your organisation's bank statement, and that

- address is the same as on your bank statement.

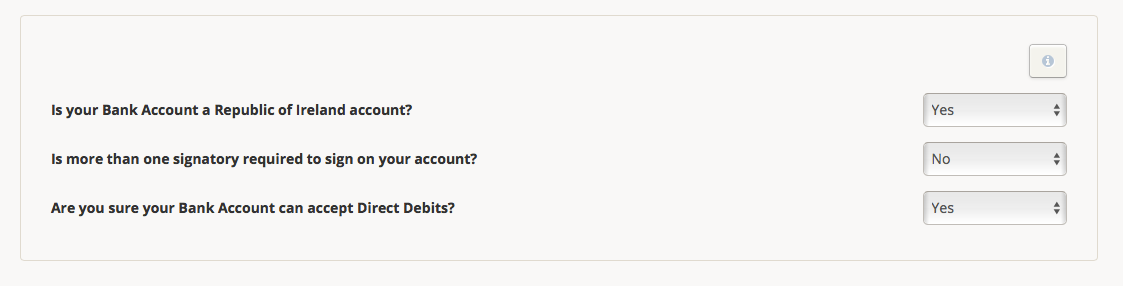

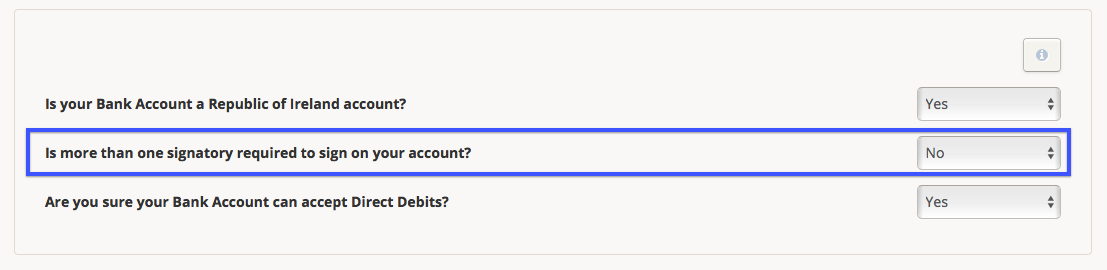

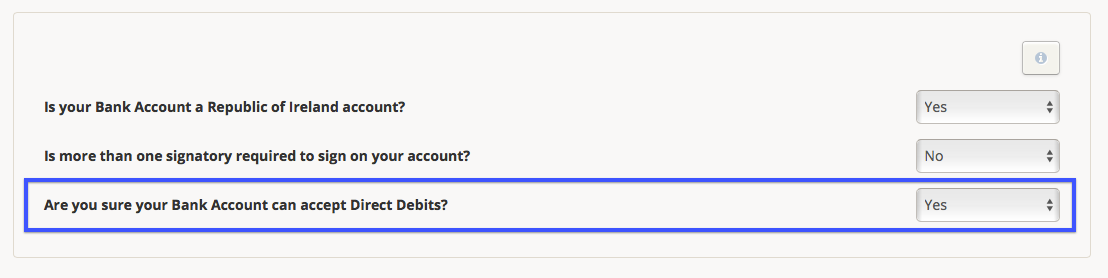

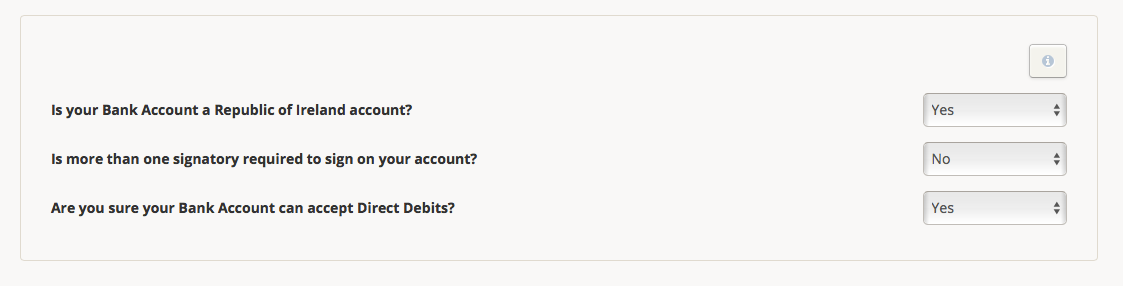

Mandatory Questions x 3: Yes, No, Yes

To set up a paperless Direct Debit you need to be able to answer the 3 questions on the SEPA Direct Debit form as 'Yes / No / Yes':

(1) - answer ‘Yes’ to "Is your Bank Account a Republic of Ireland account?".

(2) - answer ‘No’ to "Is more than one signatory required to sign on your account?". [We can only accept online Direct Debit forms if your bank account accepts just one signatory completing a Direct Debit. If you need more than one person to complete it, get in touch with us].

(3) - answer ‘Yes’ to "Are you sure your Bank Account can accept Direct Debits?".

If you cannot answer 'Yes (Q1) / No (Q2) / Yes (Q3)' for any reason, just get in touch through the button on your screen and we'll work something out (we'll need to email you a Direct Debit form to complete and return to us in the post. See When do I need to complete a paper Direct Debit Mandate?).

If you can't answer 'Yes' to any of the 3 questions above we'll need to email you a Direct Debit form to complete and return to us in the post. See When do I need to complete a paper Direct Debit Mandate?

Submit Direct Debit Mandate

When you're ready, click the 'Submit Direct Debit Mandate' button. Complyfile will then contact your bank to let them know you've set up your bank mandate.

Once you've successfully set up your DD mandate, you'll receive an email notification to the administrator's registered email address. Double check you're happy with the details inputted and keep the notification in a safe place as proof of your DD being set up successfully.

Invoices Generated

The first invoice is generated after the expiry of the free trial and completion of the payment plan, and is a pre-payment subscription for the next month (or year) ahead. The first payment will be taken on the next Complyfile payment run and monthly/annually thereafter, depending on the plan you opt for.

Going forward, invoices are accessible on a self-service basis at any time by accessing your Billing section in your Complyfile, and either viewing or downloading your invoice from there. If you have any Billing queries, please email billing@compyfile.com